Before calculating ROI, you need credible estimates of your project’s costs and benefits. The HBR Guide to Building Your Business Case by Raymond Sheen stresses that these numbers are the foundation of your business case—they tell the story of how your organization will invest and what it will gain. Start by estimating costs and benefits for your main solution, then adjust for alternatives. You don’t need perfect precision; directionally correct estimates, based on your company’s income statement (P&L) categories, are what stakeholders expect.

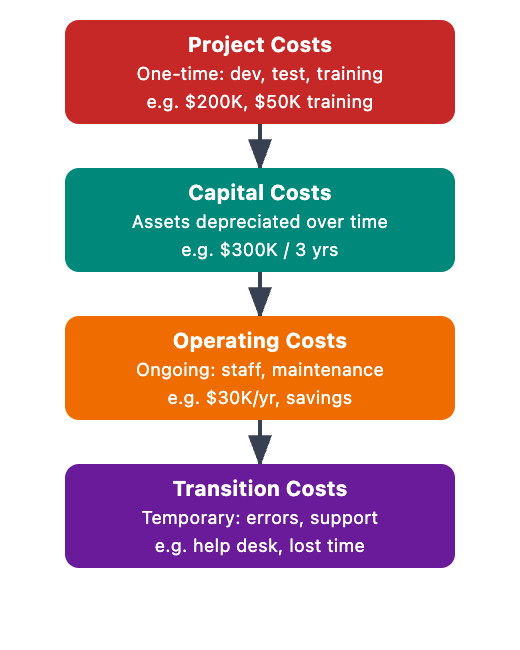

There are two main cost types you’ll need to estimate: project costs (which include both project-specific and capital expenditures) and operating costs. Project costs are typically one-time investments needed to launch or implement your solution, such as equipment purchases, software licenses, or consulting fees. Capital expenditures (CapEx) are larger, long-term investments in assets like machinery or infrastructure. Operating costs (OpEx), on the other hand, are ongoing expenses required to keep the project running—such as salaries, maintenance, and utilities.

Understanding and clearly categorizing these costs according to your company’s income statement (P&L) structure is essential for building a credible business case. Stakeholders expect to see costs broken down in familiar categories, which makes your estimates easier to review and trust.

The chart below provides a visual breakdown of typical project and operating cost categories, showing how each might appear in a business case. Use this as a reference when organizing your own estimates:

To illustrate how to approach cost estimation and categorization, here’s an example conversation between Nova (Project Lead) and Chris (Finance Partner):

Nova: “We need to estimate the costs for the new analytics platform. Should we just include the software license?”

Chris: “Let’s break it down by our P&L categories. The software license is an operating cost, but we also need to include one-time project costs like implementation and training. If we’re buying new servers, that’s CapEx.”

Nova: “Got it. So, $50,000 for implementation and training as project costs, $20,000 for the annual license as OpEx, and $80,000 for servers as CapEx. I’ll organize the estimates by these categories for the business case.”

Chris: “Perfect. That way, stakeholders can easily review and trust our numbers.”

This conversation shows how breaking down costs by familiar P&L categories—project costs, operating costs, and capital expenditures—makes your estimates clearer and more credible to stakeholders.

When calculating revenue projections, work closely with sales and marketing teams to set realistic revenue targets based on market conditions and your organization’s capabilities. Always include cost of goods sold (COGS) in your calculations to determine true gross margin, not just top-line revenue. For example: "$1,000 per unit revenue, $700 COGS = $300 gross margin per unit."

Common mistakes in revenue projections include overlooking COGS and assuming that your competitive advantage will last indefinitely. Be sure to adjust your projections to reflect both. For instance, if you expect competitors to catch up in 18 months, you might project higher margins in the early years, then lower them as competition increases (e.g., "$600,000 in year one, $700,000 in year two, $400,000 in year three").

It’s also important to consider timing—when will customers actually start paying more or purchasing additional services? There may be a delay, such as a "six-month proof period before expanded contracts", which will impact your payback period and ROI calculations.

A framework for quantifying intangible benefits—such as improved morale, customer satisfaction, or brand reputation—by translating them into measurable behaviors and, where possible, financial outcomes. Intangible benefits are often overlooked or dismissed because they seem hard to measure, but they can have a significant impact on your business case if you connect them to observable changes that affect the bottom line.

Start by identifying the specific behaviors or outcomes that your project is likely to influence. Then, estimate how those changes will translate into financial results using available data or reasonable assumptions. This approach helps make your case more concrete and credible to stakeholders who may be skeptical of “soft” benefits.

- Employee morale: Look for reduced turnover, absenteeism, or errors. For example: "Turnover drops from 2.3 to 1.2 employees/month, saving $594,000 annually."

- Customer satisfaction: Estimate increased retention, larger orders, fewer support tickets, or more referrals. For example: "Retention rises from 72% to 85%, preserving $2.3M revenue; support tickets drop 20%, saving $150,000."

- Always base estimates on specific, observable changes (e.g., "3 hours less data entry = 5 more sales calls per rep, generating $200,000 extra revenue").

If some benefits can’t be quantified, mention them for context (e.g., improved brand, compliance, or talent attraction), but don’t include them in ROI calculations.

In upcoming role-plays, you’ll practice categorizing costs, projecting revenue with COGS and competition in mind, and translating intangible benefits into measurable impacts—building business cases that withstand tough scrutiny.