As you've now mastered structured problem analysis techniques, you're ready to dive deeper into understanding the people at the heart of every product decision—your customers. While frameworks like MECE and CIRCLES help you organize thinking systematically, true product success comes from deeply understanding the humans who use your product and the competitive landscape they navigate. This lesson transforms you from a problem analyst into a customer insight expert who can uncover hidden needs, build actionable personas, and identify strategic opportunities your competitors miss.

The journey ahead explores three critical skills that separate surface-level customer understanding from genuine insight. First, you'll learn to conduct generative interviews that reveal what customers can't articulate themselves. Then, you'll discover how to synthesize research into personas that guide real decisions. Finally, you'll master the art of analyzing competitive landscapes to find differentiation opportunities. These skills work together seamlessly, helping you see beyond what customers say they want to understand what they truly need, then position your product uniquely in the market.

The most dangerous phrase in product management is "customers told us they want..." followed by a literal interpretation of their requests. Customers excel at describing their problems but struggle to articulate optimal solutions. Generative interviews help you move past surface-level feature requests to uncover the underlying needs, motivations, and contexts that drive behavior.

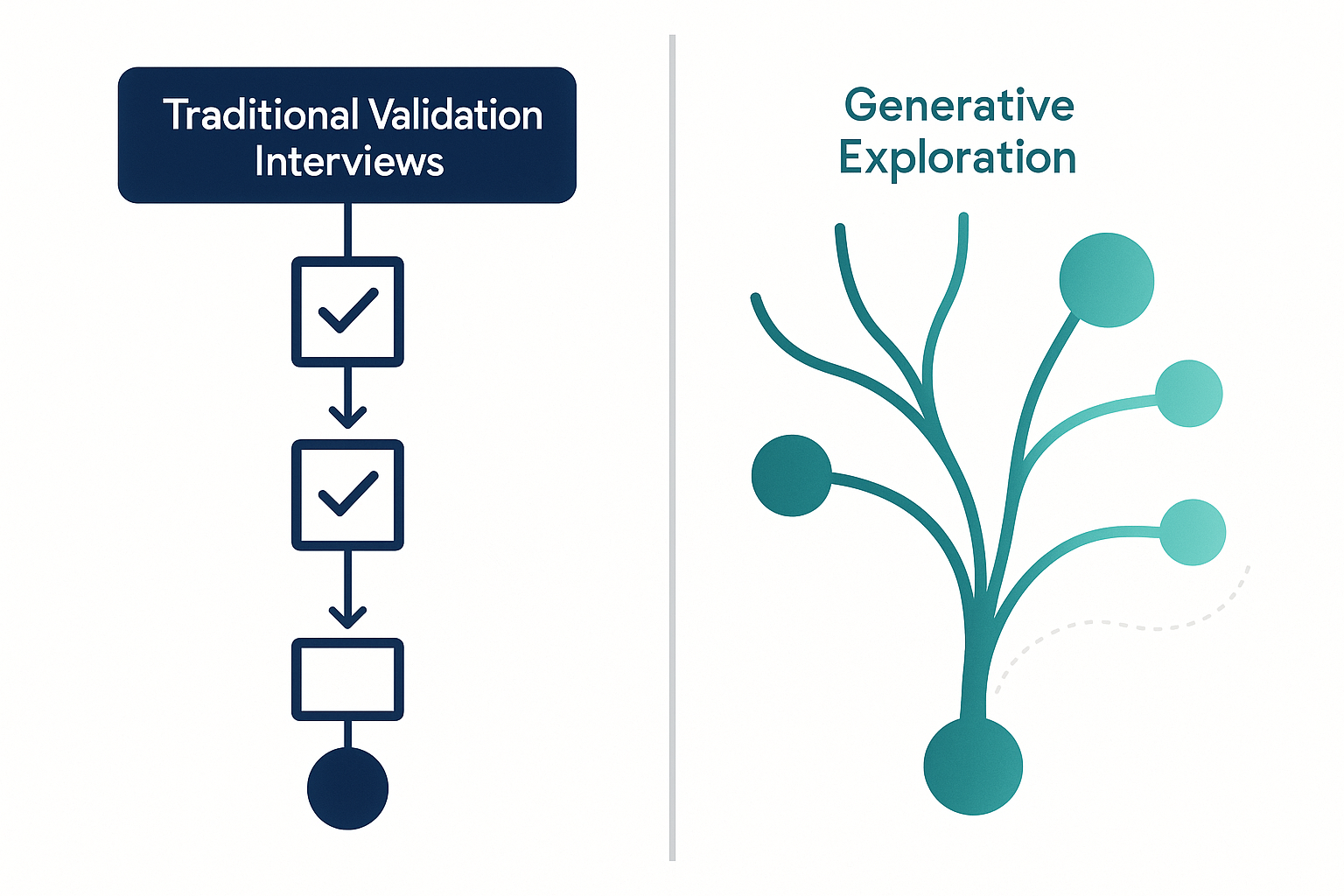

Unlike traditional interviews that validate existing hypotheses, generative interviews explore open-ended territory. You enter these conversations with curiosity rather than a checklist, allowing unexpected insights to emerge. The goal isn't to confirm what you already believe but to discover what you don't yet know. This fundamental shift means moving from asking "Would you use this feature?" to exploring "Walk me through the last time you encountered this challenge."

Let's observe how two Product Managers discuss their approach to an upcoming customer interview:

- Victoria: I've prepared a list of 15 questions about our new reporting feature. I want to ask them to rate each capability from 1 to 10.

- Chris: That might get you validation data, but will it help you understand why they need reporting in the first place?

- Victoria: Well, they've been asking for better reports for months. Isn't that enough?

- Chris: Try this instead—ask them to describe the last time they needed to share data with their team. What happened? What was frustrating?

- Victoria: But how will that tell me which features to build?

- Chris: You'll discover the real problem they're solving. Maybe they don't need reports at all—maybe they need a way to quickly communicate insights during meetings.

- Victoria: Oh, I see. So instead of asking about features, I'm exploring their actual workflow and pain points?

- Chris: Exactly. And when they mention something interesting, probe deeper with or The story they tell will reveal needs they don't even realize they have.

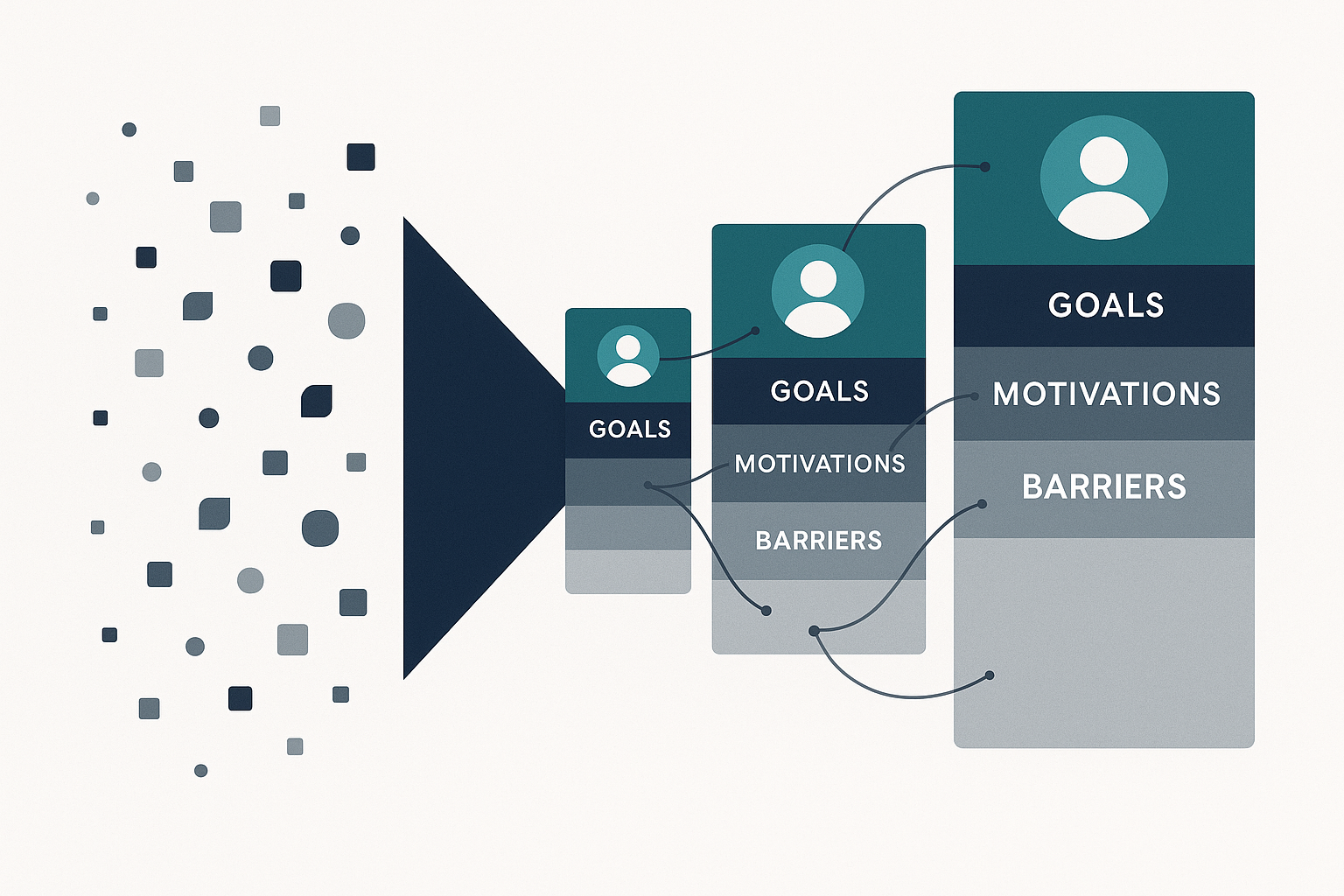

Raw interview transcripts and survey data become truly powerful when synthesized into research-backed personas—archetypal users that embody patterns discovered across multiple customers. Unlike fictional personas based on assumptions, these evidence-based profiles transform scattered insights into actionable guidance that teams can rally around.

Effective personas go far beyond demographic details like age or job title. They capture the essence of what drives user behavior through core motivations, persistent barriers, and the context in which they make decisions. A well-crafted persona answers not just who your users are, but why they behave as they do and what success looks like from their perspective.

Building research-backed personas starts with identifying behavioral patterns across your user research. Look for recurring themes in how different users approach similar problems. You might notice that despite varying job titles, one segment consistently prioritizes speed over accuracy while another values thoroughness over efficiency. These behavioral clusters form the foundation of distinct personas, each representing a meaningful user archetype with unique needs.

The anatomy of an actionable persona includes several critical elements that bring the archetype to life. Begin with the user's primary goal—what they're ultimately trying to achieve. Then identify their key motivations that drive daily decisions, the barriers that prevent success, and the specific behaviors they exhibit when using your product. Including actual quotes from research maintains authenticity and helps stakeholders connect emotionally with the persona's reality.

For instance, instead of creating "Sarah, 35, Marketing Manager," you might develop "The Overwhelmed Orchestrator" whose primary goal is "coordinating multiple campaigns without dropping balls." Her motivations include "being seen as organized and reliable" while her barriers are "constant context switching and information scattered across tools." You'd note that she "checks project status 12+ times daily" and include her actual quote:

While understanding your customers provides the foundation for product decisions, analyzing competitors reveals the strategic landscape in which those decisions play out. Competitive gap analysis goes beyond feature comparisons to identify meaningful differentiation opportunities—spaces where you can deliver unique value rather than playing catch-up.

Effective competitive analysis starts with recognizing that not all gaps represent opportunities. Your competitor might lack a feature because they've discovered customers don't actually value it, not because they haven't thought of it. The key lies in finding gaps that align with genuine user needs your personas have revealed, creating differentiation that matters rather than differentiation for its own sake.

Begin your analysis by mapping the competitive landscape across multiple dimensions. Document feature sets, but also examine pricing models, target segments, go-to-market strategies, and user experience philosophies. Sometimes the most powerful differentiation comes not from what you build but from how you deliver it. A competitor might offer similar functionality but require extensive configuration, creating an opportunity for you to differentiate through simplicity.

The most valuable insights often come from analyzing what competitors do well, not just what they lack. When a competitor dominates a particular use case, studying their approach reveals both what customers value and potential adjacencies they've overlooked. Perhaps they excel at serving enterprise customers but have created complexity that frustrates smaller teams. This gap between their strength and its unintended consequence becomes your opportunity.

Additionally, look for patterns in customer complaints about competitive products. Social media, review sites, and support forums provide unfiltered feedback about competitor weaknesses. When multiple users complain that "Product X is powerful but takes weeks to learn," you've identified a potential differentiation angle around ease of use. However, verify these complaints align with your target personas—the features power users criticize might be exactly what beginners appreciate.

Strategic gap analysis also involves understanding competitor constraints that create sustainable advantages for you. A competitor built on legacy architecture might struggle to add real-time collaboration, while your modern stack makes it trivial. They might have enterprise contracts preventing major UX changes, while your flexibility allows rapid iteration. These structural gaps provide differentiation opportunities that competitors can't easily close.