Understanding how your organization reviews and approves business cases is essential. The HBR Guide to Building Your Business Case by Raymond Sheen emphasizes that you can't tell your story effectively without knowing your audience's process, preferences, and priorities. Before developing your narrative, you need to decode the evaluation machinery that will determine your case's fate. This knowledge shapes your timing, format, emphasis, and evidence.

Many managers assume a strong ROI or obvious benefits will guarantee approval. However, even great ideas can fail if they don't align with your company's evaluation rhythm and requirements. Your business case must match your organization's review process, timeline, and decision-making style. Understanding these elements positions you strategically for approval.

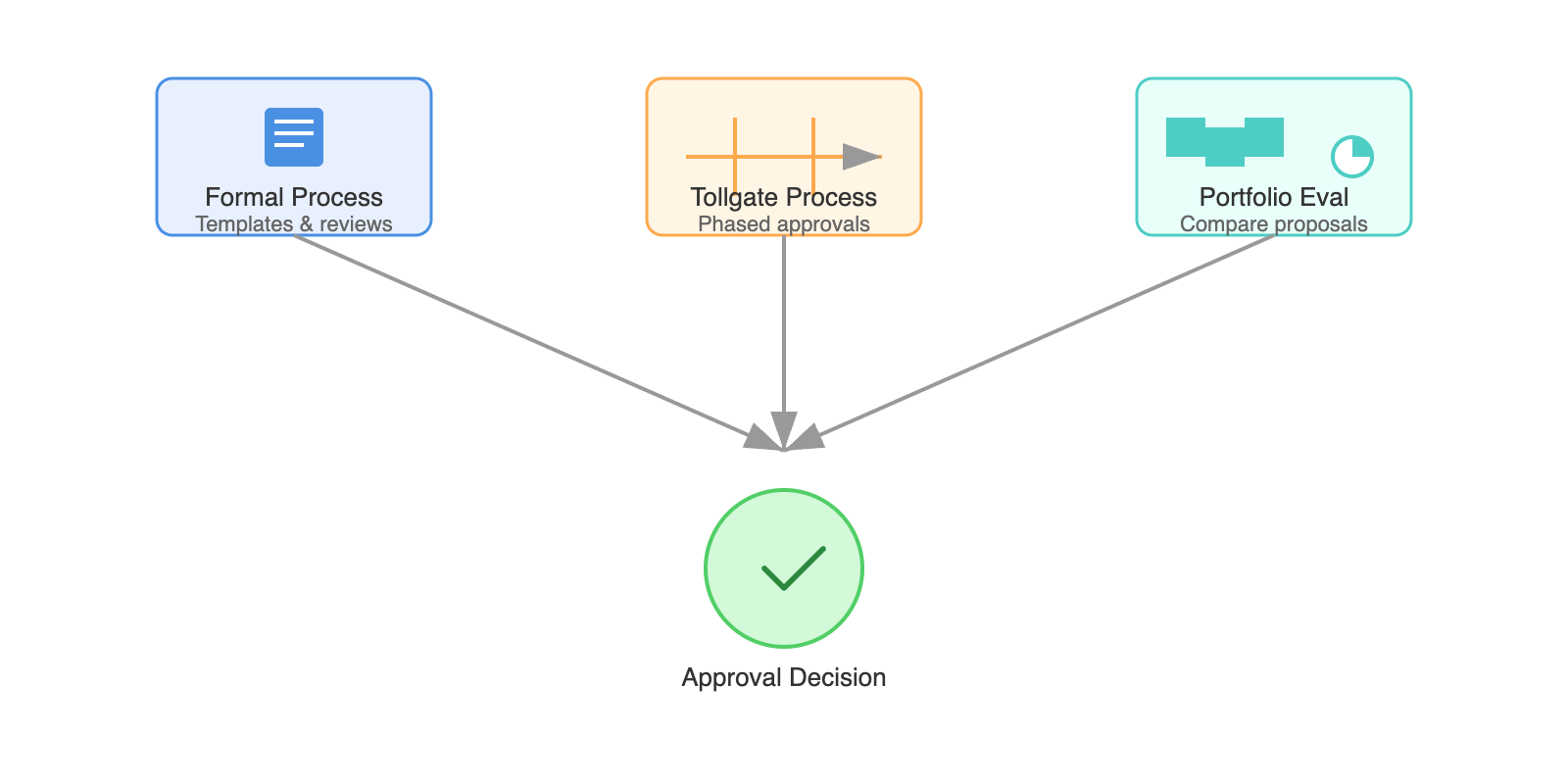

Every organization has its own approach to evaluating business cases. Large companies often have structured processes with templates and set review periods. You might encounter a tollgate process where you seek approval for an initial phase, then return for further approvals at each stage. This incremental approach lets leaders commit resources as benefits become clearer.

Every organization has its own approach to evaluating business cases. Large companies often have structured processes with templates and set review periods. You might encounter a tollgate process where you seek approval for an initial phase, then return for further approvals at each stage. This incremental approach lets leaders commit resources as benefits become clearer.

Whether your company evaluates cases individually or as a portfolio changes your strategy. In portfolio evaluation, leaders review many cases at once, allocating budgets across priorities. Your case competes not just on its own merits but against others in its category, so you must show why it’s more valuable than alternatives.

The expected level of detail also varies. Some companies want granular sales projections; others prefer high-level estimates. Some use standardized templates for fair comparisons, while others allow more creative freedom. Even if the process feels constraining, you must work within it to succeed.

One IT manager learned his company valued business impact over technical detail by observing successful presentations. Your job is to uncover similar insights—do reviewers prioritize quick wins or long-term transformation, innovation or risk mitigation, data or narrative? Careful observation and the right questions will reveal what really matters.

Timing can make or break your business case. Many companies review cases at specific times tied to fiscal years or budgeting seasons. Knowing this rhythm lets you position your case when resources are available and decision makers are ready.

Large organizations often review projects during annual budget cycles, but the guide notes that companies may set aside budget for off-cycle opportunities. These windows are ideal for urgent initiatives that can't wait for the next formal review. For example, one company reviewed cases monthly, so proposals addressing recent pain points had more urgency and a higher chance of approval.

Budget cycle alignment is about more than dates; it’s about mindset. During main budget allocation, reviewers think strategically about long-term investments. Off-cycle reviews focus on quick wins or urgent problems. A project with a three-year payback might succeed in annual planning but fail in a quarterly review focused on immediate results. Your story must match both the process and the mindset of your timing window.

The best intelligence about your company's evaluation process comes from colleagues who've succeeded. Reaching out to those with a track record of approval can help you learn what actually works in practice. These conversations reveal unwritten rules and hidden dynamics that official documentation often overlooks.

When analyzing successful cases, look for patterns: What forms did they use? Which decision makers did they engage? What level of detail did they provide? Did they emphasize strategic alignment, ROI, innovation, or risk mitigation? For example, you might find that "Every approved project in the last year had a clear customer impact story, even the internal IT initiatives." Such insights help you frame your narrative to match what actually gets approved.

Consider this exchange:

- Jessica: I'm struggling with my customer service platform proposal. I have great ROI numbers, but my last two cases were rejected.

- Ryan: I felt the same way until I realized our company doesn't just care about the numbers. What helped me get three approvals last year was understanding the unwritten rules.

- Jessica: Unwritten rules? The evaluation guide seems pretty clear about what they want.

- Ryan: That's what I thought too. But did you know that proposals submitted two weeks before the formal review get informal feedback that dramatically improves success rates?

- Jessica: No one told me that! What else have you learned?

- Ryan: The CFO always asks about implementation risks because of that ERP disaster three years ago. If you don't have a solid risk mitigation slide, you're done. Also, they prefer phased approaches now—asking for $2 million upfront will fail, but $500K for phase one usually works.

- Jessica: This is exactly what I needed to know. Can I see one of your successful presentations?

- Ryan: Sure, but more importantly, look at when I submitted it. Q1 proposals get fresh budget, but Q4 is almost impossible unless it's addressing an urgent crisis.

Ryan shares both formal insights (risk mitigation slides) and informal patterns (two-week advance submission) that Jessica wouldn’t find in official documentation. This kind of intelligence turns guessing into knowing.

Studying rejected cases is equally important. You may wish to examine previous failed proposals for common pitfalls. Maybe they lacked stakeholder buy-in or underestimated complexity. One manager found that "proposals asking for more than $2 million always got rejected in Q4 when budgets were tight, but the same proposals succeeded in Q1 with fresh budget." These patterns are warning signs to avoid.